Shop Car Insurance Quotes to Get Better Premium Rates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the world of car insurance, we uncover the importance of shopping around for quotes to secure the best premium rates.

Importance of Shopping for Car Insurance Quotes

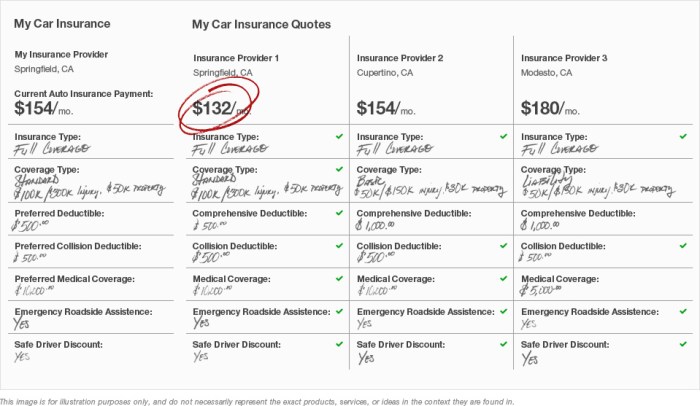

When it comes to car insurance, shopping around for quotes is crucial in order to find the best coverage at the most affordable rates. By comparing quotes from different insurance providers, you can ensure that you are getting the most value for your money and not overpaying for the same coverage.

How Shopping Around Can Help in Getting Better Premium Rates

Shopping around for car insurance quotes allows you to explore a range of options and find the best deal that fits your budget and coverage needs. Different insurance companies calculate premiums based on various factors such as your driving record, age, location, and type of vehicle, which can result in varying quotes for the same coverage.

- Insurance companies may offer discounts or special deals that can lower your premium rates significantly. By comparing quotes, you can take advantage of these offers and save money on your car insurance.

- Some insurance providers may specialize in certain types of coverage or cater to specific demographics, which can result in more competitive rates for certain groups of drivers.

- Factors like the level of coverage, deductibles, and additional features can also impact the premium rates offered by different insurance companies. By comparing quotes, you can tailor your policy to meet your needs while staying within your budget.

Factors Affecting Car Insurance Premium Rates

When it comes to determining car insurance premium rates, there are several key factors that insurance companies take into consideration. These factors play a significant role in how much you will pay for your car insurance coverage. Understanding these factors can help you make informed decisions to potentially lower your insurance rates.

Age

Age is a crucial factor that affects car insurance premium rates. Younger drivers, especially those under the age of 25, typically pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher premiums as they may experience declines in vision, reaction time, and overall driving capabilities.

Driving Record

Your driving record is another important factor that influences car insurance rates. Drivers with a history of accidents, traffic violations, or DUI convictions are considered high-risk and are likely to pay more for insurance. On the contrary, drivers with a clean record are rewarded with lower premiums as they are perceived as safer and more responsible behind the wheel.

Location

Where you live also plays a role in determining your car insurance premiums. Urban areas with higher traffic congestion and crime rates tend to have higher insurance costs compared to rural areas. Additionally, the likelihood of theft or vandalism in your neighborhood can impact your insurance rates.

By understanding these key factors that affect car insurance premium rates, you can take proactive steps to potentially lower your insurance costs. Maintaining a clean driving record, choosing a safe vehicle, and exploring available discounts are some ways to mitigate the impact of these factors on your insurance rates.

Comparison of Different Insurance Providers

When comparing different insurance providers, it's essential to look at the coverage options they offer, as well as how their reputation and customer service can impact the premium rates you receive.

Coverage Options

- Insurance Provider A: Offers comprehensive coverage that includes protection against various types of damages, theft, and liability.

- Insurance Provider B: Focuses on providing customizable plans that allow you to tailor your coverage to fit your specific needs.

Reputation and Customer Service

- Insurance Provider A: Known for its excellent customer service and quick claims processing, which may result in slightly higher premium rates.

- Insurance Provider B: Has a reputation for being budget-friendly with competitive rates, but customer service reviews may vary.

Popular Insurance Companies

- Progressive: Well-known for offering a variety of discounts and competitive rates for drivers of all ages.

- Geico: Recognized for its user-friendly online platform and ability to provide quick and easy quotes.

Tips for Finding the Best Premium Rates

When it comes to finding the best premium rates for car insurance, there are several strategies and tips that can help you secure a better deal. From comparing quotes to negotiating with insurance companies, being proactive and informed can make a significant difference in the rates you pay.

Comparing Multiple Quotes

- Get quotes from multiple insurance providers to compare rates and coverage options.

- Consider both online comparison tools and speaking directly with agents to get a comprehensive view of available options.

- Look for discounts or special offers that could help lower your premium rates.

Negotiating for Better Rates

- Be prepared to negotiate with insurance companies based on the quotes you have gathered.

- Highlight your clean driving record, any safety features in your vehicle, and your loyalty as a customer to potentially receive discounts.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, for additional savings.

Regular Policy Reviews

- Review your insurance policies annually to ensure you have adequate coverage and are not overpaying for unnecessary extras.

- Update your policy details if there have been changes in your driving habits, vehicle usage, or personal circumstances that could impact your rates.

- Stay informed about any changes in insurance regulations or laws that could affect your coverage or premium rates.

Last Word

In conclusion, shopping for car insurance quotes is not just a task but a strategic move towards saving on premium rates. By comparing quotes, understanding key factors, and exploring different providers, you can unlock the best deals suited to your needs.

Stay informed, stay protected.

General Inquiries

Why is shopping for car insurance quotes crucial?

Shopping for car insurance quotes is crucial as it allows you to compare rates from different providers and find the best premium rates tailored to your needs.

How can factors like age and driving record impact premium rates?

Factors like age and driving record can impact premium rates as insurance companies assess risk levels based on these factors. Younger drivers or those with poor driving records may face higher premiums.

What are some strategies for negotiating with insurance companies for better rates?

Negotiating for better rates can involve bundling policies, improving your credit score, or taking advantage of discounts. It's essential to highlight your good driving history and loyalty as a customer.

Why is it important to review and update insurance policies regularly?

Reviewing and updating insurance policies regularly ensures that you have adequate coverage and are not overpaying for services you no longer need. It helps you stay up-to-date with any changes in your circumstances.