Shop Car Insurance Quotes Before Renewal to Save Money sets the stage for this informative discussion, shedding light on the importance of comparing car insurance quotes before renewing. By exploring the factors to consider, steps to take, and online tools available, readers can unlock significant savings and make informed decisions about their car insurance coverage.

Importance of Shopping Car Insurance Quotes Before Renewal

When it comes to renewing your car insurance, taking the time to shop around and compare quotes can make a significant impact on your finances. Here's why it's crucial to explore your options before renewing:

Save Money on Premiums

By shopping car insurance quotes before renewal, you have the opportunity to find a better deal that could potentially save you a significant amount of money on your premiums. Insurance companies often offer competitive rates to attract new customers, so it's worth exploring your options to see if you can find a more affordable policy.

Identify Discounts and Special Offers

When comparing car insurance quotes, you may come across discounts and special offers that you were not aware of. These discounts could be based on your driving history, the safety features of your car, or even your loyalty to a particular insurance provider.

By shopping around, you can take advantage of these opportunities to lower your insurance costs.

Ensure Adequate Coverage

Another benefit of shopping car insurance quotes before renewal is that you can ensure you have adequate coverage for your needs. Your circumstances may have changed since you last renewed your policy, and it's essential to review your coverage options to make sure you are adequately protected in case of an accident or other unforeseen events.

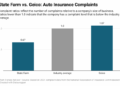

Compare Customer Service and Reviews

By exploring different insurance providers and their quotes, you can also assess their customer service reputation and read reviews from other policyholders. Choosing an insurance company with excellent customer service can provide you with peace of mind knowing that you will be well taken care of in case you need to file a claim or seek assistance.

Factors to Consider When Shopping for Car Insurance Quotes

When comparing car insurance quotes, there are several key factors to keep in mind to ensure you are getting the best coverage at the most competitive price. Understanding these factors can help you make an informed decision that meets your needs and budget.

Coverage Options

- Consider the types of coverage offered, such as liability, collision, comprehensive, and personal injury protection.

- Ensure the coverage limits are adequate to protect you in case of an accident or other incidents.

- Look for any additional coverage options, like roadside assistance or rental car reimbursement, that may be valuable to you.

Deductible

- Compare the deductibles offered by different insurers, as a higher deductible can lower your premium but may require you to pay more out of pocket in the event of a claim.

- Find a deductible amount that you are comfortable with and that fits your financial situation.

Discounts

- Ask about available discounts, such as for bundling policies, safe driving records, or taking a defensive driving course.

- Take advantage of any discounts that you qualify for to lower your overall insurance costs.

Driving Record and Location

- Your driving record, including any accidents or traffic violations, can impact your insurance rates. A clean driving record typically results in lower premiums.

- Your location also plays a role, as areas with higher rates of accidents or theft may have higher insurance premiums.

- Be aware of how your driving history and location can influence the cost of your car insurance.

Steps to Take When Shopping for Car Insurance Quotes

When shopping for car insurance quotes, it's important to follow a systematic approach to ensure you get the best coverage at the most competitive rates. Here is a step-by-step guide on how to effectively shop for car insurance quotes:

1. Gather Necessary Information

Before starting your search, make sure you have all the relevant information handy, such as your driver's license, vehicle registration, current insurance policy details, and driving history.

2. Research Different Providers

Take the time to research and compare quotes from multiple insurance providers. Look for reputable companies with good customer reviews and competitive rates.

3. Compare Quotes

Once you have gathered quotes from different providers, compare them side by side. Pay attention to the coverage limits, deductibles, and any additional benefits offered by each policy

4. Review Policy Details

Before making a decision, carefully review the policy details, including coverage exclusions, limitations, and any hidden fees. Make sure you understand what is covered and what is not under each policy.

5. Ask Questions

If you have any doubts or need clarification on certain aspects of the policy, don't hesitate to ask questions. Reach out to the insurance provider or agent to get all the information you need to make an informed decision.

6. Consider Discounts

Inquire about any discounts that you may qualify for, such as safe driver discounts, multi-policy discounts, or discounts for installing safety devices in your vehicle. These discounts can help lower your premium costs.

7. Finalize Your Decision

Once you have compared quotes, reviewed policy details, and considered any discounts, you can make an informed decision on which car insurance policy best suits your needs and budget.

Utilizing Online Tools and Platforms for Comparing Car Insurance Quotes

When it comes to finding the best car insurance rates, utilizing online tools and platforms for comparing quotes can be highly beneficial. These tools allow you to easily compare different insurance providers, coverage options, and prices all in one place, saving you time and potentially saving you money as well.

Benefits of Using Online Comparison Tools

- Convenience: Online tools allow you to compare multiple car insurance quotes from the comfort of your own home, eliminating the need to contact each provider individually.

- Time-saving: Instead of spending hours on the phone or visiting different insurance offices, you can quickly get multiple quotes with just a few clicks.

- Cost-effective: By comparing quotes online, you can easily find the best rates and potentially save money on your car insurance premiums.

Popular Websites for Car Insurance Quote Comparisons

- Insurify:Insurify is a popular platform that allows you to compare personalized car insurance quotes from multiple providers.

- The Zebra:The Zebra is another website that offers a simple and easy way to compare car insurance quotes and find the best coverage for your needs.

- Compare.com:With Compare.com, you can compare quotes from top insurance companies and easily switch to a new policy if you find a better deal.

How to Use Online Comparison Tools Effectively

- Enter accurate information: Make sure to provide correct details about your vehicle, driving history, and coverage preferences to get the most accurate quotes.

- Compare multiple quotes: Don't settle for the first quote you receive. Compare multiple quotes to ensure you are getting the best deal.

- Review coverage options: Take the time to review the coverage options included in each quote to ensure you are getting the right level of protection for your needs.

Ending Remarks

In conclusion, shopping for car insurance quotes before renewal is a smart financial move that can lead to substantial savings. By following the Artikeld steps and leveraging online tools, individuals can secure the best rates and coverage options tailored to their needs.

Don't miss out on potential savings – start comparing quotes today and ensure you're getting the most value out of your car insurance policy.

Key Questions Answered

Why is it crucial to compare car insurance quotes before renewing?

Comparing car insurance quotes allows you to find better deals, potentially saving you money on your premiums.

What factors should I consider when shopping for car insurance quotes?

Key factors include coverage options, deductible amounts, available discounts, driving record, and location.

How can online tools help in comparing car insurance quotes?

Online tools provide a convenient way to compare rates from different providers, helping you find the best deal quickly and efficiently.

Are there specific websites or platforms recommended for comparing car insurance quotes?

Popular platforms like Compare.com, Gabi, and The Zebra can help in comparing car insurance quotes effectively.