Embark on a journey into the realm of customizing auto policy quotes tailored to your unique requirements. Unravel the intricacies of customization that can enhance your coverage and save costs effectively.

Delve into the various factors that can be personalized within auto policy quotes to suit your individual needs and preferences.

Introduction to Customizing Auto Policy Quotes

When it comes to auto insurance, one size does not fit all. Customizing auto policy quotes to suit individual needs is crucial in ensuring adequate coverage and cost savings. By tailoring your policy to your specific requirements, you can avoid paying for unnecessary coverage while securing protection where you need it most.

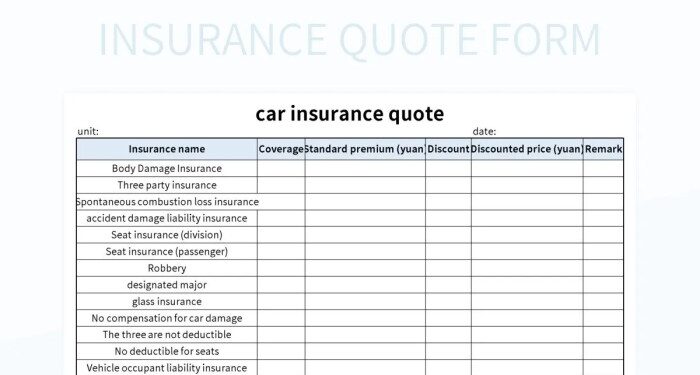

Factors to Customize in Auto Policy Quotes:

- Liability Limits: Adjusting the limits of liability coverage to match your assets and potential risks can help you avoid being underinsured in case of an accident.

- Deductibles: Choosing higher deductibles can lower your premiums, but it's important to set them at a level you can afford in the event of a claim.

- Add-On Coverage: Consider adding extras like roadside assistance, rental car reimbursement, or gap insurance based on your needs and budget.

- Policy Discounts: Take advantage of discounts for safe driving, bundling policies, or being a loyal customer to reduce your overall insurance costs.

Factors to Consider for Customization

When customizing your auto policy quotes, it's essential to take into account various factors that can impact the coverage options available to you. Factors such as age, location, driving history, deductibles, limits, and add-ons all play a crucial role in tailoring your auto policy to meet your specific needs.

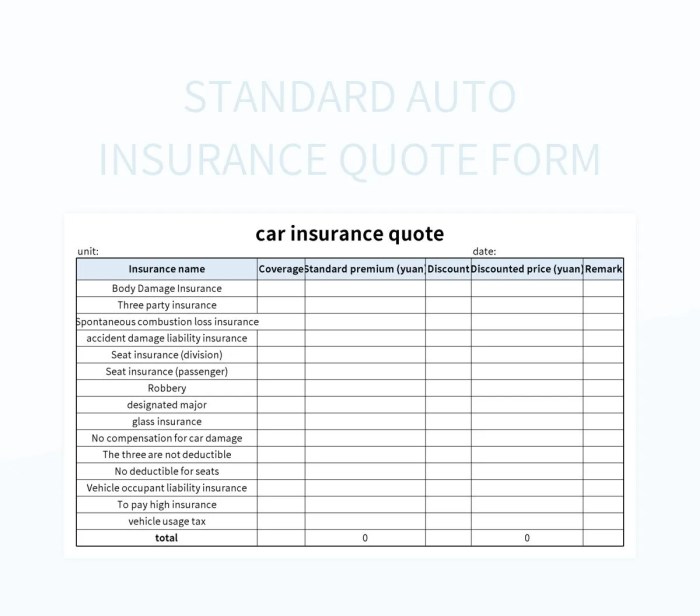

Types of Coverage Options

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This pays for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: This covers damages to your vehicle not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're in an accident with a driver who has insufficient or no insurance.

Impact of Personal Information

Personal information such as age, location, and driving history can significantly impact how your auto policy is customized. Younger drivers or those with a history of accidents may face higher premiums, while older, experienced drivers may qualify for discounts. Your location can also affect rates due to factors like crime rates and traffic congestion.

Role of Deductibles, Limits, and Add-Ons

- Deductibles: This is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium but means you'll pay more in the event of a claim.

- Limits: These are the maximum amounts your insurance will pay for specific types of coverage. It's crucial to select limits that adequately protect you without overpaying for unnecessary coverage.

- Add-Ons: Optional coverage options, such as roadside assistance or rental car reimbursement, can be added to your policy for extra protection. Consider your needs and budget when deciding which add-ons to include.

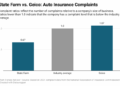

Comparison of Policy Options

When customizing auto policy quotes, it is crucial to understand the different types of coverage options available to tailor your policy to meet your specific needs. Let's compare and contrast comprehensive, collision, liability, and other coverage types to help you make an informed decision.

Comprehensive Coverage

Comprehensive coverage provides protection for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters. While this coverage offers extensive protection, it is typically more expensive than other options. Comprehensive coverage is beneficial for newer vehicles or in areas prone to theft or severe weather conditions.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident with another vehicle or object. This coverage is essential for protecting your vehicle in case of a collision, but it may not cover all damages depending on the circumstances.

Collision coverage is recommended for vehicles with a higher value or for drivers who frequently commute in heavy traffic areas.

Liability Coverage

Liability coverage is mandatory in most states and covers bodily injury and property damage that you are legally responsible for in an accident. This coverage does not protect your vehicle but safeguards you from financial losses if you cause an accident.

Liability coverage is essential for all drivers to meet legal requirements and protect themselves from potential lawsuits.

Other Coverage Types

Other coverage options include uninsured/underinsured motorist coverage, personal injury protection, and rental reimbursement coverage. Uninsured/underinsured motorist coverage protects you if you are in an accident with a driver who does not have insurance or enough coverage

Rental reimbursement coverage helps pay for a rental car if your vehicle is being repaired after an accident.Understanding the benefits and drawbacks of each type of coverage will help you customize your auto policy quotes to suit your individual needs and budget effectively.

Customization Process

When customizing auto policy quotes, it is important to follow a structured approach to ensure you get the coverage that best fits your needs. This process involves adjusting coverage limits, deductibles, and negotiating with insurance providers for custom quotes.

Adjusting Coverage Limits and Deductibles

- Assess your individual needs: Consider factors such as your driving habits, the value of your vehicle, and your financial situation to determine the appropriate coverage limits.

- Customize coverage options: Tailor your policy by adding or removing coverage options based on what is important to you, such as comprehensive, collision, or uninsured motorist coverage.

- Modify deductibles: Choosing higher deductibles can lower your premium but also increase out-of-pocket expenses in the event of a claim. Adjust deductibles based on what you can comfortably afford.

Negotiating with Insurance Providers

- Research and compare quotes: Obtain quotes from multiple insurance providers to have a basis for negotiation. Compare coverage options and pricing to identify the best value.

- Highlight your loyalty and driving record: Emphasize any loyalty to the insurance company or a good driving record to potentially qualify for discounts or better rates.

- Ask for discounts or custom packages: Inquire about available discounts, bundle policies, or inquire about customizing a package that meets your specific needs.

Advanced Customization Techniques

When looking to further tailor your auto policy quotes to your specific needs, there are several advanced customization techniques to consider. These techniques can help you optimize your coverage while still staying within your budget constraints.

Bundling Options for Multiple Insurance Policies

One advanced customization technique to explore is bundling options for multiple insurance policies. By bundling your auto insurance with other types of insurance, such as home or life insurance, you may be eligible for significant discounts. This can help you save money while ensuring you have comprehensive coverage across all your insurance needs.

Impact of Credit Score and Occupation on Policy Customization

Your credit score and occupation can have a significant impact on the customization of your auto policy quotes. Insurance companies often take these factors into account when determining your premiums. Maintaining a good credit score and choosing an occupation with lower risk factors can potentially lower your insurance costs.

It's important to be aware of how these factors can influence your policy customization options.

Strategies for Optimizing Coverage within Budget Constraints

When customizing your auto policy quotes, it's essential to strategize on optimizing your coverage within your budget constraints. One effective strategy is to carefully review your coverage needs and adjust your deductibles accordingly. By choosing higher deductibles for lower premiums, you can strike a balance between coverage and affordability.

Additionally, consider eliminating coverage options that may not be necessary for your specific situation, freeing up funds to allocate towards essential coverage areas.

Final Review

In conclusion, mastering the art of customizing auto policy quotes is key to ensuring optimal coverage that aligns perfectly with your requirements. Empower yourself with the knowledge gained from this guide to make informed decisions and secure the best policy for your needs.

Question Bank

How can I customize my auto policy quotes to fit my specific needs?

By adjusting coverage limits, deductibles, and exploring add-ons that cater to your individual requirements, you can tailor your auto policy quotes effectively.

What factors can impact the customization of auto policy quotes?

Personal details like age, location, and driving history play a crucial role in determining how your auto policy quotes can be customized to best suit you.

Is negotiating with insurance providers for custom quotes a common practice?

Yes, negotiating can often lead to more personalized and cost-effective auto policy quotes that align better with your needs and budget.