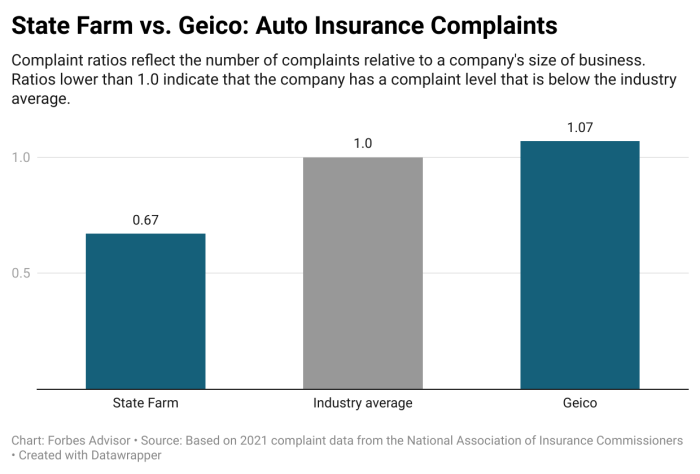

Delve into the realm of Geico Commercial Auto Insurance vs State Farm Comparison, where we uncover the nuances and intricacies of these two insurance giants. Brace yourself for a journey filled with revelations and valuable insights that will reshape your understanding of commercial auto insurance providers.

As we navigate through the details of coverage options, pricing structures, customer service, and technological tools, you'll gain a comprehensive view of how Geico and State Farm stack up against each other.

Comparison Overview

When it comes to commercial auto insurance, Geico and State Farm are two prominent providers in the industry, each offering a range of coverage options tailored to meet the needs of businesses. Let's take a closer look at what sets these two insurance giants apart.

Geico Commercial Auto Insurance

Geico, short for Government Employees Insurance Company, has been serving customers since 1936 and is known for its catchy advertising campaigns featuring a gecko. Geico offers commercial auto insurance policies that provide coverage for vehicles used for business purposes, including cars, trucks, vans, and more.

Their policies typically include liability coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage.

State Farm Commercial Auto Insurance

State Farm, founded in 1922, is one of the largest insurance providers in the United States. State Farm's commercial auto insurance policies cater to businesses of all sizes, offering coverage for a variety of vehicles used for business operations. Similar to Geico, State Farm's policies include liability coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage.

Key Similarities and Differences

- Both Geico and State Farm offer commercial auto insurance policies with similar coverage options, such as liability, comprehensive, collision, and uninsured/underinsured motorist coverage.

- Geico is known for its direct-to-consumer business model, while State Farm operates through a network of agents, providing a more personalized approach to customer service.

- State Farm may offer more customizable options and additional features in their commercial auto insurance policies compared to Geico.

- Geico is often recognized for its competitive rates and discounts, appealing to cost-conscious businesses.

Coverage Options

In the realm of commercial auto insurance, having the right coverage options is crucial for protecting your business. Let's explore the types of coverage available from Geico and State Farm, as well as any unique offerings they provide to tailor to specific business needs.

Types of Coverage

When it comes to coverage options, both Geico and State Farm offer standard options such as liability, collision, and comprehensive coverage. These foundational coverages are essential for protecting your vehicles and business in case of accidents or unforeseen events.

Unique Offerings

Geico stands out with their specialized coverage options like their Mechanical Breakdown Insurance (MBI), which covers repairs for mechanical failures not caused by accidents. This can be a valuable add-on for businesses relying heavily on their vehicles for operations.On the other hand, State Farm offers unique coverage options such as rideshare insurance, which provides coverage for drivers who use their vehicles for ridesharing services like Uber or Lyft.

This specialized coverage ensures that businesses operating in the rideshare industry are adequately protected.

Tailored Coverage

Both Geico and State Farm allow for the customization of coverage options to meet specific business needs. This means that businesses can adjust their coverage limits, deductibles, and add-on options to create a policy that aligns with their unique operations and risks.By understanding the coverage options available from Geico and State Farm, businesses can make informed decisions to protect their assets and operations effectively.

Pricing and Discounts

When it comes to commercial auto insurance, pricing and discounts play a significant role in helping businesses save money while ensuring adequate coverage. Let's take a closer look at how Geico Commercial Auto Insurance and State Farm compare in terms of pricing structures and discounts.

Geico Commercial Auto Insurance Pricing

Geico is known for offering competitive rates for commercial auto insurance. The pricing structure is based on various factors such as the type of vehicles, coverage limits, and the driving history of the insured business. Businesses can customize their policies to suit their specific needs and budget.

Geico also offers discounts for businesses with multiple vehicles, good driving records, and those who bundle their commercial auto insurance with other policies.

Geico Commercial Auto Insurance Discounts

Multi-Vehicle Discount

Businesses that insure multiple vehicles with Geico can qualify for a discount on their premiums.

Safe Driver Discount

Geico rewards businesses with good driving records by offering discounts on their commercial auto insurance.

Bundling Discount

Businesses can save money by bundling their commercial auto insurance with other policies offered by Geico.

State Farm Commercial Auto Insurance Pricing

State Farm also provides competitive pricing for commercial auto insurance. The cost of coverage depends on factors like the type of vehicles, coverage options, and the business's location. State Farm offers businesses the flexibility to tailor their policies to meet their specific needs.

Additionally, businesses can benefit from discounts offered by State Farm to help reduce their insurance costs.

State Farm Commercial Auto Insurance Discounts

Business Experience Discount

State Farm offers discounts to businesses with a proven track record of safe driving and years of experience

Vehicle Safety Features Discount

Businesses that equip their vehicles with safety features may be eligible for discounts on their commercial auto insurance premiums.

Loyalty Discount

State Farm rewards businesses that have been long-term customers with discounts on their commercial auto insurance.Both Geico Commercial Auto Insurance and State Farm offer competitive pricing and discounts to help businesses save money on their commercial auto insurance coverage. By exploring the pricing structures and taking advantage of available discounts, businesses can find cost-effective solutions to protect their vehicles and assets.

Customer Service and Claims

When it comes to commercial auto insurance, the customer service and claims process are crucial aspects to consider. Let's take a closer look at how Geico and State Farm fare in this area.

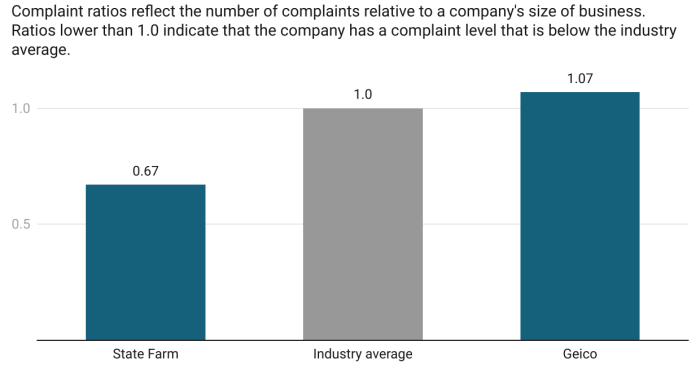

Geico Customer Service and Claims

Geico is known for its efficient and responsive customer service when it comes to handling commercial auto insurance claims. Customers often praise Geico for their quick claim processing and helpful representatives. The ease of filing claims online or through their mobile app adds to the convenience for policyholders.

Overall, Geico has a solid reputation for providing excellent customer service in the event of a claim.

State Farm Customer Service and Claims

State Farm is also highly regarded for its customer service and claims handling for commercial auto insurance. Customers appreciate the personalized attention they receive when filing a claim with State Farm. The insurance company has a large network of agents who can assist policyholders throughout the claims process.

State Farm is known for its prompt responses and dedication to resolving claims efficiently.

Technology and Tools

In today's digital age, having access to advanced technology and tools can greatly enhance the overall customer experience when managing commercial auto insurance policies. Let's explore the digital resources provided by Geico and State Farm that aim to streamline insurance processes for policyholders.

Mobile Apps and Online Portals

Both Geico and State Farm offer mobile apps and online portals that allow policyholders to conveniently manage their commercial auto insurance policies. These platforms provide easy access to important policy information, allow users to make payments, file claims, request roadside assistance, and even access digital ID cards on the go.

Digital Claims Processing

One of the key technological advancements in the insurance industry is digital claims processing. Both Geico and State Farm have implemented systems that enable policyholders to file and track claims online, reducing the need for paperwork and streamlining the claims process.

This not only saves time but also ensures a more efficient claims experience for customers.

Telematics and Usage-Based Insurance

Some insurance companies, including State Farm, offer telematics programs that utilize technology to track vehicle usage and driving behavior. This data can be used to provide personalized insurance rates based on individual driving habits. By leveraging telematics technology, policyholders have the opportunity to save money on their commercial auto insurance premiums by demonstrating safe driving practices.

Customer Support Chatbots

Another innovative tool that both Geico and State Farm have implemented is the use of customer support chatbots. These AI-powered chatbots are available 24/7 to assist policyholders with any questions they may have regarding their insurance policies. This instant access to information enhances customer service and provides quick resolutions to common inquiries.

Virtual Assistance and Video Claims Processing

In addition to chatbots, some insurance companies offer virtual assistance and video claims processing options. This allows policyholders to interact with insurance representatives remotely through video calls, making it easier to assess damages and expedite the claims process. By incorporating virtual assistance, insurance companies aim to provide a more personalized and efficient claims experience for their customers.

Ending Remarks

In conclusion, the comparison between Geico Commercial Auto Insurance and State Farm unveils a dynamic landscape of offerings and services. Whether you're prioritizing coverage options, pricing flexibility, or seamless customer experience, this exploration has shed light on the strengths and unique advantages of each provider.

Detailed FAQs

Is Geico or State Farm better for commercial auto insurance?

It depends on your specific business needs and preferences. Geico may offer competitive pricing, while State Farm could provide more personalized customer service.

Do Geico and State Farm offer similar coverage options?

Both companies offer a range of coverage options for commercial auto insurance, but the specifics may vary. It's essential to compare the details to find the best fit for your business.

Are there any unique discounts provided by Geico or State Farm?

Both Geico and State Farm offer various discounts for commercial auto insurance policies, such as multi-policy discounts or safe driver incentives. Check with each provider to see which discounts apply to your situation.