As Auto Policy Quotes Comparison: 5 Best Websites to Try takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this article, we will delve into the realm of auto policy quote comparison, shedding light on the importance of comparing quotes from various websites and finding the best policy tailored to individual needs. Let's explore the top 5 websites that offer this service and analyze coverage options, pricing, discounts, customer reviews, and satisfaction levels.

Introduction to Auto Policy Quote Comparison

Auto policy quotes are estimates provided by insurance companies detailing the cost of coverage for a specific vehicle. These quotes are essential for individuals looking to purchase auto insurance as they Artikel the premiums, deductibles, and coverage options available.

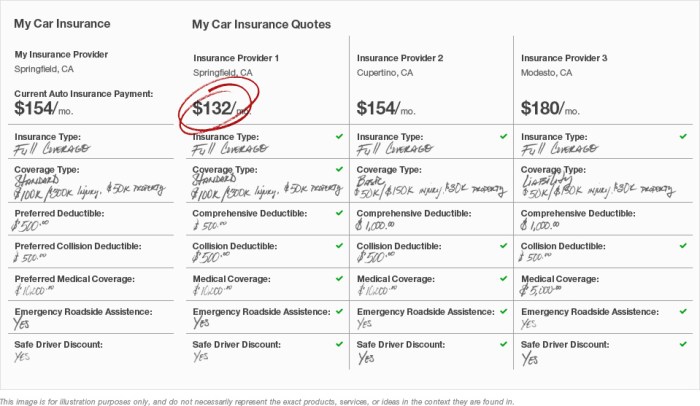

Comparing quotes from different websites is crucial in order to find the best policy that suits individual needs. By obtaining quotes from multiple sources, individuals can evaluate the costs and coverage options offered by various insurance providers to make an informed decision.

Importance of Comparing Auto Policy Quotes

When it comes to auto insurance, not all policies are created equal. Comparing quotes from different websites allows individuals to identify the most cost-effective option that provides the necessary coverage. By comparing quotes, individuals can also ensure they are not overpaying for insurance and can potentially save money in the long run.

Top 5 Websites for Auto Policy Quotes Comparison

When looking for the best auto policy quotes, it's essential to compare options from multiple websites to find the most competitive rates and coverage. Here are five websites that offer reliable auto policy quote comparison services:

1. Insurance.com

Insurance.com is a comprehensive website that allows users to compare auto policy quotes from multiple insurance providers. To obtain a quote, users need to provide information such as their vehicle details, driving history, and coverage preferences. The user interface is user-friendly, with clear navigation to input all necessary information efficiently.

2. Compare.com

Compare.com is another popular platform for comparing auto policy quotes. Users can input details about their vehicle, driving record, and coverage needs to receive personalized quotes from various insurance companies. The website's interface is intuitive, making it easy for users to navigate through the quote comparison process.

3. NerdWallet

NerdWallet is known for providing unbiased financial advice, including auto policy quote comparisons. Users can enter their car information, driving history, and coverage requirements to receive quotes from different insurers. The website's interface is clean and straightforward, guiding users through the quote comparison process seamlessly.

4. The Zebra

The Zebra is a popular platform for comparing auto insurance quotes quickly and easily. Users need to input details about their vehicle, driving habits, and coverage preferences to receive quotes from various insurance companies. The website's interface is modern and user-friendly, allowing users to compare quotes efficiently.

5. Gabi

Gabi is a website that specializes in comparing auto insurance quotes to help users find the best rates. By providing information about their vehicle, driving history, and coverage needs, users can receive personalized quotes from different insurers. The website's interface is sleek and intuitive, simplifying the process of comparing auto policy quotes.

Coverage Options Comparison

When comparing auto policy quotes, it's essential to look at the coverage options offered by different websites. These options can vary in terms of coverage levels, deductibles, and additional services, so it's crucial to understand the differences to make an informed decision.

Liability Coverage

- Website A offers liability coverage with a minimum limit of $50,000.

- Website B provides liability coverage with a minimum limit of $100,000.

- Website C allows you to customize your liability coverage limits based on your needs.

- Website D includes liability coverage as part of their basic policy package.

- Website E offers liability coverage with an option for umbrella coverage for added protection.

Comprehensive and Collision Coverage

- Website A offers comprehensive and collision coverage with a deductible of $500.

- Website B provides the option to choose deductibles for comprehensive and collision coverage, ranging from $250 to $1,000.

- Website C includes roadside assistance and rental car reimbursement with their comprehensive and collision coverage.

- Website D offers new car replacement coverage for vehicles less than two years old.

- Website E allows you to add custom parts and equipment coverage for aftermarket additions to your vehicle.

Additional Services

- Website A offers a mobile app for easy claims filing and policy management.

- Website B provides a discount for policyholders who complete a defensive driving course.

- Website C offers a loyalty discount for customers who renew their policies.

- Website D has a 24/7 customer service hotline for assistance with claims or policy questions.

- Website E includes a usage-based insurance option for drivers who want to save based on their driving habits.

Pricing and Discounts

When comparing auto policy quotes, pricing and discounts play a crucial role in determining the overall cost of coverage. It is important to understand how each website structures its pricing and applies discounts to help you make an informed decision.

Website Pricing Structures

- Website A: Offers competitive pricing based on driving history and vehicle information.

- Website B: Provides personalized quotes based on driving habits and location.

- Website C: Offers discounts for bundling policies or maintaining a clean driving record.

- Website D: Utilizes a reward system for safe driving behaviors and loyalty.

- Website E: Focuses on providing affordable options for young drivers and students.

Discount Eligibility Criteria

- Safe Driver Discount: Typically requires a clean driving record with no accidents or traffic violations.

- Multi-Policy Discount: Available when bundling auto and home insurance policies.

- Good Student Discount: Often applies to students with a certain GPA or academic achievement.

- Low Mileage Discount: Offered to drivers who do not exceed a specified number of miles annually.

- Affinity Group Discount: Available to members of certain organizations or professions.

Tips for Maximizing Savings

- Compare Multiple Quotes: Get quotes from different websites to find the best rate.

- Ask About Available Discounts: Inquire about all possible discounts you may qualify for.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your rates low.

- Bundle Policies: Consider bundling auto and home insurance for additional savings.

- Take Advantage of Loyalty Programs: Stay with the same insurance provider to benefit from loyalty rewards.

Customer Reviews and Satisfaction

Customer reviews play a crucial role in the decision-making process when choosing an auto policy provider. They provide valuable insights into the quality of service, claims process, and overall customer satisfaction. Let's take a look at the customer satisfaction ratings for the top 5 websites for auto policy quotes comparison.

Overview of Customer Satisfaction Ratings

- Website A: Website A has received consistently positive reviews from customers, with high ratings for customer service and claims handling. Many customers have praised the ease of use of the website and the competitive pricing offered.

- Website B: Customers have reported mixed reviews for Website B, with some highlighting excellent customer service and competitive rates, while others have expressed concerns about delayed claim processing times.

- Website C: Website C has garnered high customer satisfaction ratings, with many customers commending the user-friendly interface and the wide range of coverage options available.

- Website D: Customers have praised Website D for its personalized customer service and quick claims processing. The website's transparency in pricing and discounts has also been well-received.

- Website E: Website E has received positive feedback from customers for its comprehensive coverage options and competitive pricing. Customers have also appreciated the responsive customer support team.

Final Thoughts

In conclusion, Auto Policy Quotes Comparison: 5 Best Websites to Try provides valuable insights into navigating the world of auto insurance policies. By considering the information presented here, readers can make informed decisions when selecting the most suitable policy for their unique requirements.

Stay informed, stay protected.

FAQs

What information do you need to compare auto policy quotes across websites?

To compare auto policy quotes effectively, you will typically need details such as your vehicle information, driving history, desired coverage levels, and personal details like age and location.

How can I maximize savings on auto insurance through available discounts?

To maximize savings on auto insurance, consider bundling policies, maintaining a good driving record, opting for a higher deductible, and inquiring about discounts for safety features or driving less.

Why are customer reviews important when choosing an auto insurance policy?

Customer reviews offer insights into the quality of service, claim process efficiency, and overall satisfaction levels with an insurance provider. They can help you gauge the reliability and reputation of the company.